Mini Tax LLM™

A Practical And Hands-On Crash Course Covering Business Law, Estate Law, Nonprofit Law, And Tax Law Strategies, Concepts, and Case Studies

Press Play To Watch The Video

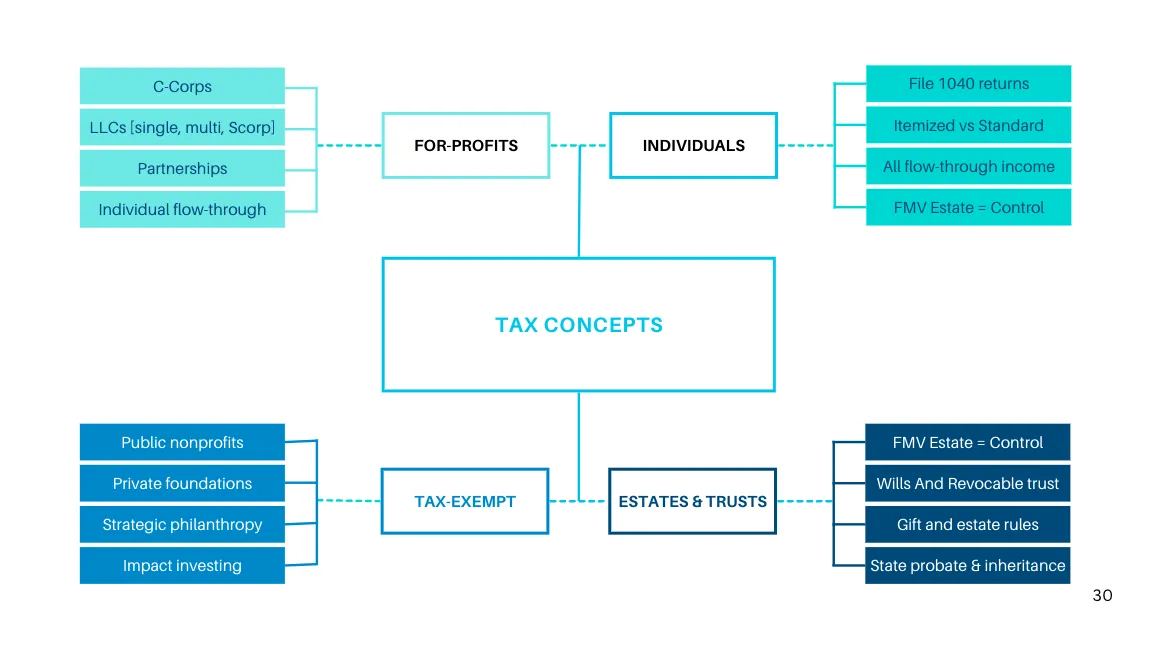

The Mini Tax LLM Program Covers Various Tax Concepts From A High-Level Overview As Well As Highly Nuanced Topics & Strategies

High-Level Overview Of Topics Covered

In-Depth Courses Of Nuanced Strategies

Here are some examples of videos and presentations included in the Mini Tax LLM - these videos were designed for our referral partners (accountants, financial advisors, and insurance agents) and their clients

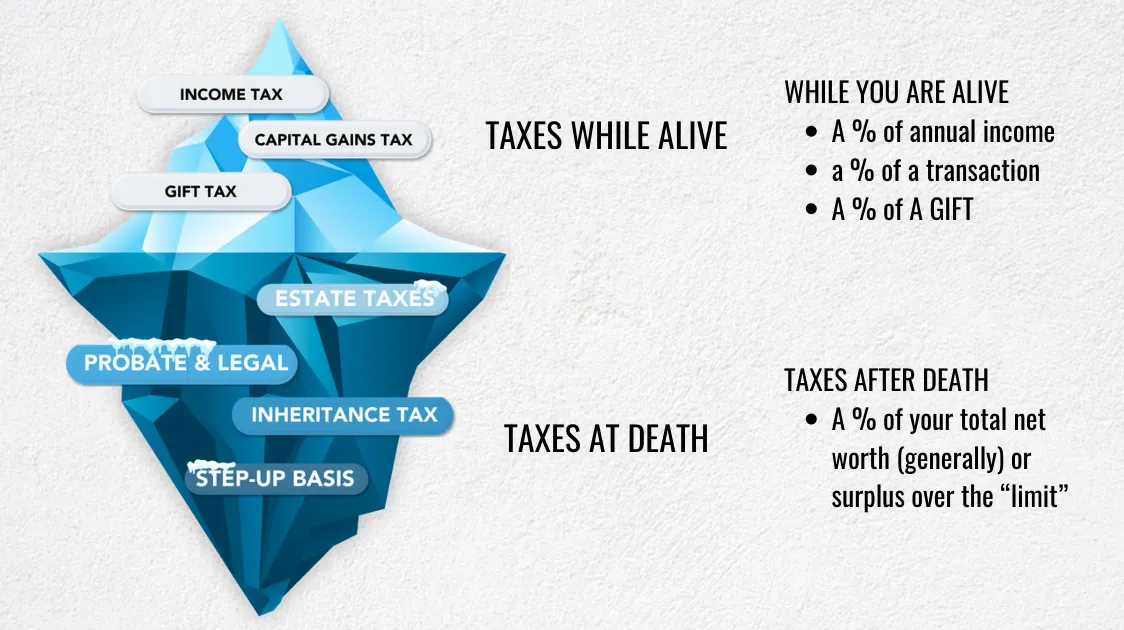

THE BIG PICTURE: Tax Iceberg™

This intro course will give you an idea of how the tax code is structured and how different taxes are imposed.

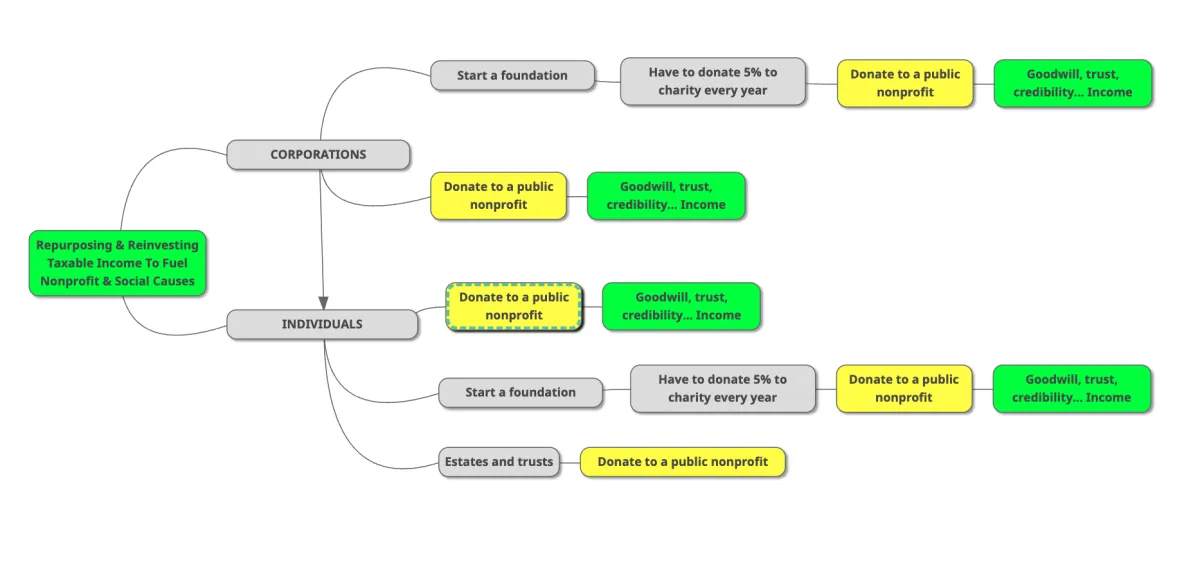

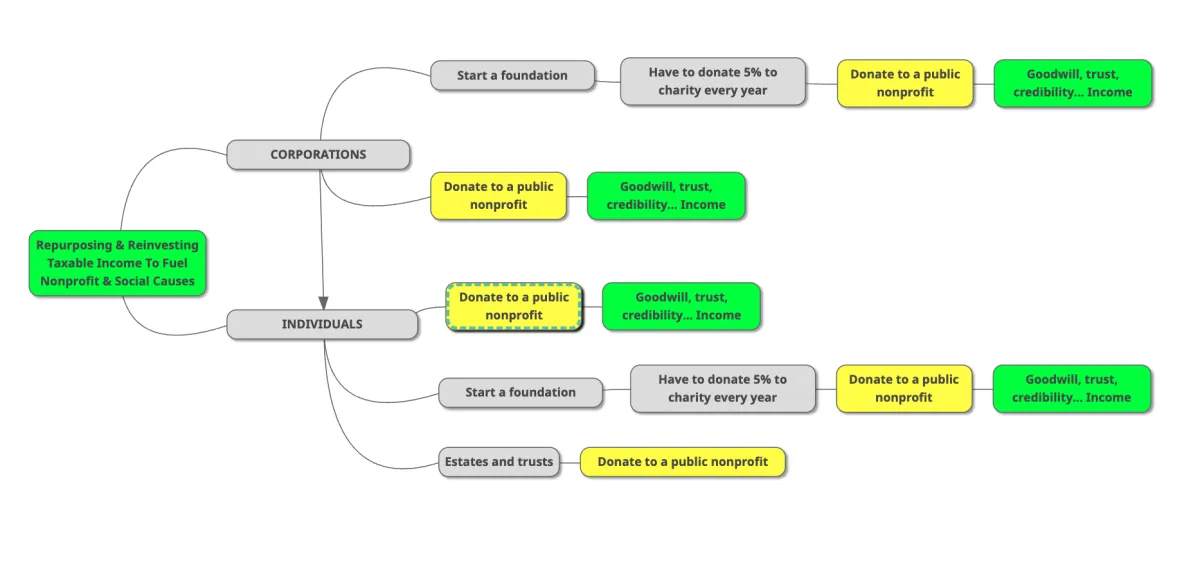

HOW TAX DOLLARS ARE "RECYCLED"

Discover how each dollar is circulated several times as it changes hands and how tax strategy can change lives.

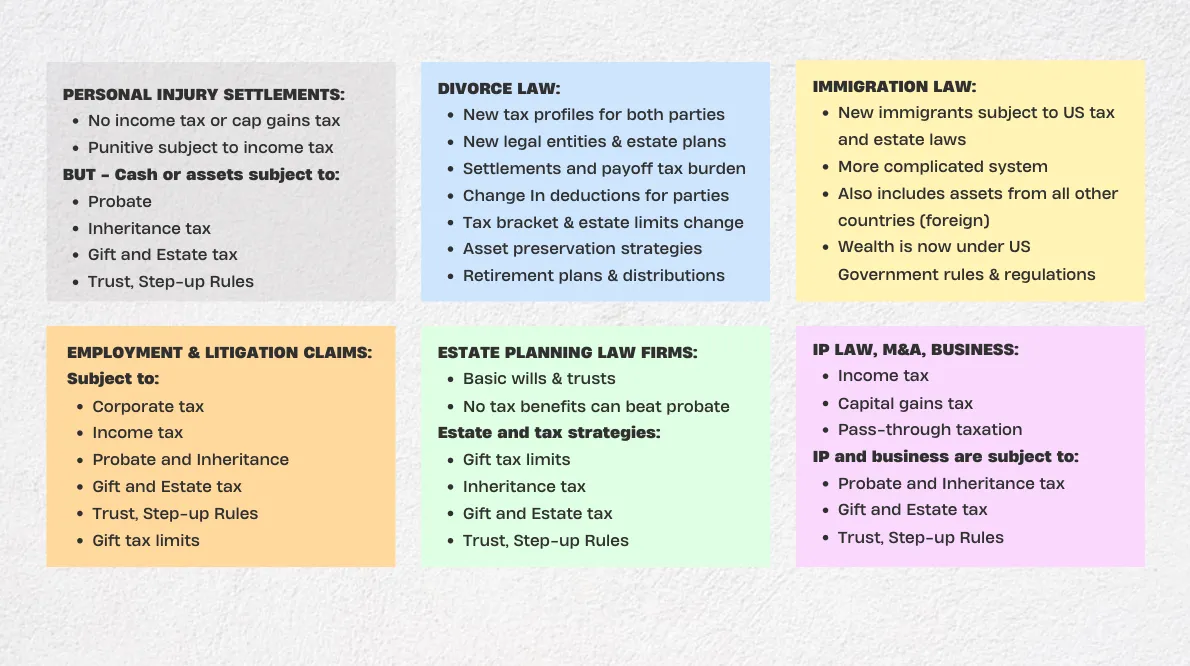

TAX STRATEGY IN DIFFERENT AREAS

Learn to identify and solve tax obligations that your legal services may cause for your clients.

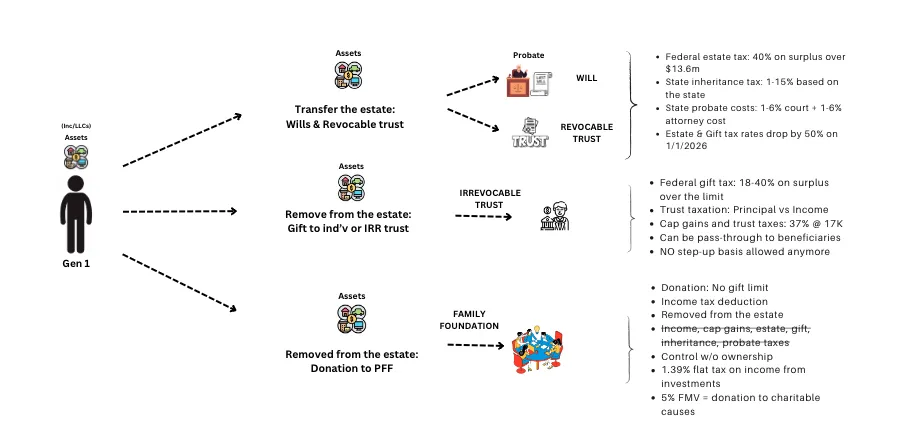

WTF: Wills, Trusts & Foundations

Learn how different legal entities can be leveraged strategies to protect your assets from all multiple sides.

Lowering Capital Gain Taxes

Learn how different taxes work and how they play a part in asset protection & estate planning.

Lowering Estate Size

Learn how to strategically use trusts and foundations to remove assets from your name (estate).

THE ART OF ESTATE PLANNING

A guide for entrepreneurs and investors looking to protect assets, reduce taxes, and transfer wealth in an efficient and economical way.

GIFT TAX CONCEPTS

In this webinar and accompanying article, you'll learn about gift taxes when transferring wealth to an individual or to a trust.

START A NONPROFIT ORGANIZATION

In this presentation, you'll learn how to start and grow a nonprofit organization and aligning between your financial and philanthropic goals.

Expiration 12/31/2025: Act Now

In this crash course, you'll learn how the upcoming tax reduction laws impact you and how to circumvent those changes strategically.

The Mini Family Office™

How to become irreplaceable by creating the systems that align law, tax, and financial decisions for your clients under one roof.

Nonprofits & Foundations

This article explores the advanced tax and investment benefits of becoming a philanthropist and impact investor through nonprofits & foundations.

© Copyrighted Material 2024. All rights reserved.

Mini Tax LLM™ c/o Estate Law Training Center

IMPORTANT: LEGAL DISCLAIMER

Mini Tax LLM is not an accredited law school program or affiliated with any law school or university. We are not a CLE provider and no credits will be awarded for any participation in the program.